VISION

Excellence in the government financial management through enhanced professionalism

MISSION

Ensure prudent use of public resources through judicious expenditure management, efficient fiscal transfers and treasury operations with highest degree of competence.

VALUES

• Integrity

• Objectivity

• Transparency

• Accountability

• Professionalism

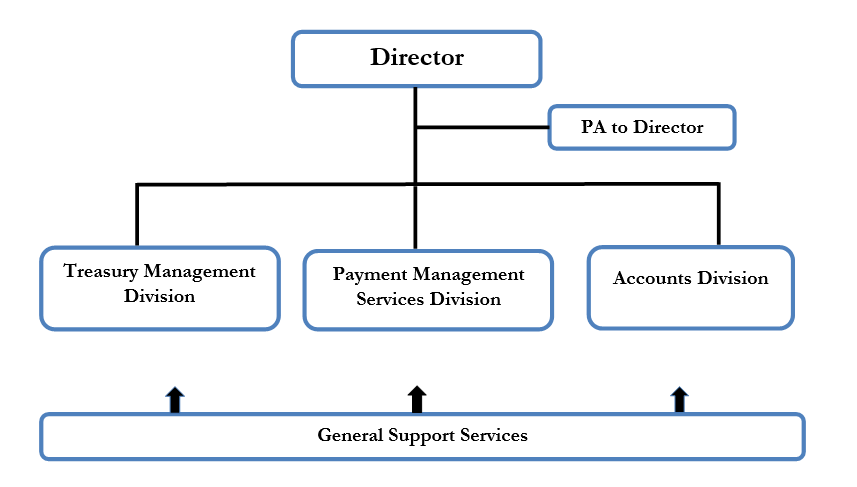

ORGANOGRAM

Roles and Responsibilities

The Department of Treasury and Accounts shall have a sound government accounting system with professional finance personnel based on the following principles as laid down in the Public Finance Act of Bhutan.

- (a) Efficiency

- (b) Economy

- (c) Effectiveness

- (d) Equity

- (e) Sustainability

- (f) Transparency, and

- (g) Accountability

In order to achieve the objectives of the Department, the roles and responsibilities of the respective Divisions are as below:

Treasury Management Division (TMD)

- Verify and approve Budgetary Release based on Budgetary Release Forecast (BRF)

- Non-Budgetary Release -Refundable Deposit Releases and Non Revenue Releases

- Preparation and monitoring of Pre-financing for Donor funded budgets

- Review and validation of lapsed Non-Budgetary Deposits and releases

- Review, revise and update fund release guidelines

- Opening and monitoring of LC/PLC accounts and CD accounts

- Liaise with the Royal Monetary Authority and other financial institutions for effective treasury management.

- Review and revise the procedures for operation of the Government bank accounts.

- Review and revise the procedures for operation of the Government bank accounts.

- Issuance of Treasury bills and monitoring of the redemptions of the same

- Reconciliation of Government Budget Fund Account

- Reconciliation of grants, loans, trust and endowment funds, and other receipts & payments for the consolidation of Annual Financial Statements.

Division Portal Address : https://sites.google.com/mof.gov.bt/tmdportalforbudgetarybodies/home

Accounts Division (AD)

- Prepare consolidated Annual Financial Statements for the Government.

- Revise and issue Finance and Accounting Manual (FAM).

- Financial Analysis and Reporting

- Provide clarifications and interpretations on the Finance and Accounting Manual.

- Provide information on government expenditures to the relevant stakeholders.

- Promote good financial management practices through PFM reform initiatives.

- Operate Common Public Expenditure (CPE) Account for release of funds to non-budgetary bodies and State-Owned Enterprises (SOEs).

Payment Management Services Division (PMSD)

- Assess and carry out enhancements of the accounting and payment system of the Government.

- Provide technical backstopping and conduct user trainings.

- Carry out system integration with other relevant systems.

- Monitor accounting transactions and provide required interventions.

- Validate party details and ensure security of the data.

- Promote good financial management system and provide support to PFM reform initiatives.

- Liaise with the Royal Monetary Authority and other financial institutions to ensure smooth payment and settlement process.

The Department of Treasury and Accounts shall always strive to achieve its goals and objectives through promotion of high standards of professionalism in accomplishing the overall mandates of the Ministry of Finance.

53,493 total views, 6 views today